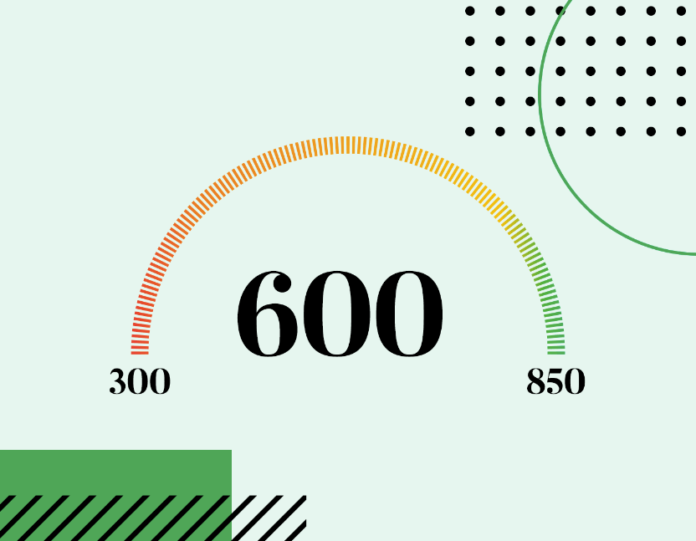

In today’s financial landscape, your credit score plays a pivotal role in determining your ability to access credit, secure loans, or even rent an apartment. A credit score falls within the fair credit range, but what does that mean for you? World of credit scores, particularly focusing on a credit score. We will explore what it entails, how it can impact your financial life, and what steps you can take to improve it. Let’s embark on this journey to demystify the 600 credit score.

What is a 600 Credit Score?

A 600 credit score is a numerical representation of your creditworthiness. Higher scores indicating better creditworthiness. A score of 600 falls within the fair credit category, which means it’s not excellent, but it’s not poor either.

Factors Influencing Your Credit Score

- Payment History: This is the most significant factor. It reflects whether you’ve paid your bills on time and if you’ve had any late payments or defaults.

- Length of Credit History: The longer your credit history, the better it is for your score.

- New Credit Inquiries: Opening multiple new credit accounts in a short time can lower your score.

The Impact of a 600 Credit

Having a 600 credit can affect various aspects of your financial life:

Limited Borrowing Options

With a 600 credit, you may still qualify for loans and credit cards, but they are likely to come with higher interest rates and less favorable terms. Lenders view you as a moderate risk borrower, which can limit your borrowing options.

Higher Interest Rates

This means you’ll end up paying more for loans and credit cards over time.

Difficulty in Renting

Considering rental applications. A lower score may make securing the apartment or home you desire harder.

Improving Your 600 Credit Score

The good news is that you can take steps to improve your credit score:

1. Pay Bills on Time

Consistently paying bills on time is the most effective way to boost your credit score.

2. Reduce Credit Card Balances

Lowering your credit card balances can positively impact your credit utilization ratio. Aim to keep your balances well below your credit limits.

3. Avoid Opening Too Many Accounts

Limit the number of new credit accounts you open to avoid potential negative impacts on your score. Read more…

Conclusion

In the world of personal finance, a 600 credit score is a significant milestone. While it may not grant you access to the best financial products and terms, it’s not a dead end. You can move towards a more favorable credit score by practicing responsible financial habits and consciously improving your credit. Remember, your credit score is a dynamic number that can change over time with diligent effort.

FAQs

1. Can I get a mortgage with a 600 credit score?

While getting a mortgage with a 600 score is possible, you may face challenges in securing favorable terms. Lenders typically prefer borrowers with higher credit scores for mortgage loans.

2. How long does it take to improve a 600 score?

Improving a 600 score can take time. It depends on your financial habits and how diligently you work on improving your credit. It may take several months to see significant changes.

3. Will my credit score improve if I pay off collections?

Paying off collections can positively impact your credit score but may result in a small increase. It’s important to continue practicing good credit habits to see lasting improvements.

4. Can I rent an apartment with a credit score?

You can still rent an apartment with a credit score, but you may need to provide additional documentation or a co-signer to secure the lease, especially in competitive rental markets.

5. Is it worth using credit repair services with a credit score?

Using credit repair services can be helpful if you have errors on your credit report or need assistance in managing your debts. However, be cautious of scams and choose reputable services if you seek professional help.