In today’s financial landscape, a credit score of 650 holds significant relevance. Determining your financial health and stability. It affects your ability to secure loans, obtain credit cards, and even influences the interest rates you’ll be offered. Nuances of a 650 credit score, exploring what it means, how to improve it, and the impact it has on your financial life.

What is a 650 Credit Score?

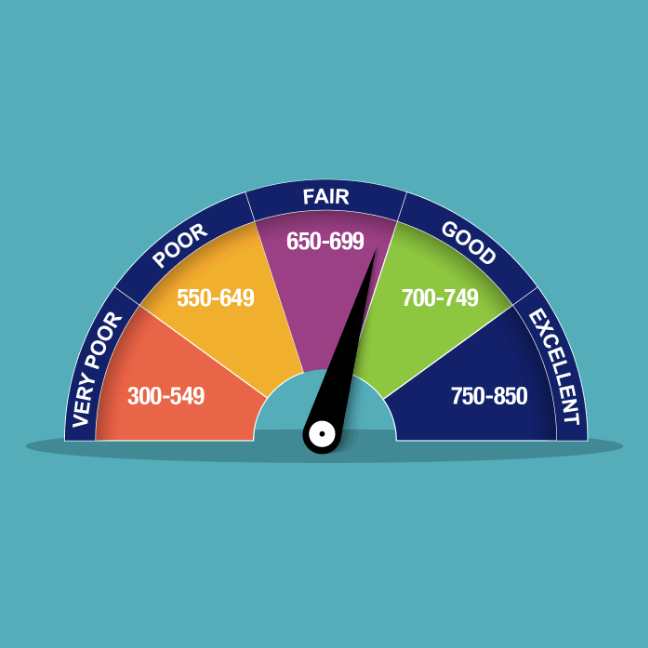

A 650 credit score, often considered fair, falls within the range of 580 to 669 on the FICO scale. It’s a numeric representation of your creditworthiness, providing creditors and lenders insight into your financial history and ability to manage debt. While it may not be the highest score, it’s crucial to understand that it can still open doors to various financial opportunities.

The Factors Behind a 650 Credit Score

Your credit score isn’t randomly assigned; it’s a result of your financial behavior and history. Several factors contribute to a credit score, including:

1. Payment History (H1)

One of the most critical factors is your payment history. Lenders want to see that you’ve consistently paid your bills on time. Late payments or defaults can significantly impact your score.

2. Length of Credit History (H3)

The longer your credit history, the better. A longer history provides a more comprehensive picture of your financial responsibility.

The Importance of a Credit Score

Now that we’ve covered what a credit score is and the factors that influence it, let’s explore why it’s essential:

1. Loan Eligibility (H2)

With a credit score, you become eligible for various types of loans, including personal, auto, and even some mortgages. While interest rates might not be the lowest, having access to credit is crucial.

2. Renting an Apartment (H3)

Landlords often check credit scores when considering rental applications. A credit score can make it easier to secure a lease.

3. Employment (H3)

Some employers may review credit reports as part of the hiring process, particularly for positions involving financial responsibilities.

How to Improve Your Credit Score

If you currently hold a credit score and want to enhance it, follow these tips:

1. Pay Bills on Time (H2)

Consistently pay your bills by their due dates to avoid late payments, which can harm your score.

2. Reduce Credit Card Balances (H2)

Work on paying down credit card balances to lower your credit utilization ratio.

3. Avoid Opening New Credit Accounts (H2)

Opening too many new credit accounts in a short period can lower your score. Be cautious when applying for new credit.

4. Check Your Credit Report (H2)

Regularly review your credit report for errors or discrepancies. Dispute any inaccuracies you find. Read more…

Conclusion

In conclusion, a 650 credit score is a valuable asset in the world of finance. While it may not be perfect, it opens doors to numerous opportunities and can be improved with responsible financial management. Habits, so make conscious efforts to maintain and enhance it.

FAQs

1. What’s the difference between a 650 and a 700 credit score?

A 700 credit score is considered good, while a 650 score is fair. The main difference is the level of creditworthiness they represent, impacting the types of financial opportunities available to you.

2. Is it possible to have a 650 credit score with no credit history?

It’s unlikely to have a credit score with no credit history. Typically, a score of 650 reflects a history of credit usage and payment.

3. Can a credit score be considered for a business loan?

While a credit score may qualify you for certain business loans, a higher score is generally preferred by lenders for better terms and rates.