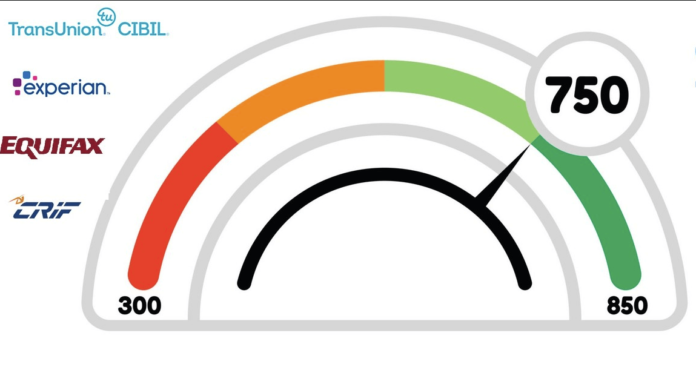

In today’s fast-paced financial world, opportunities. A credit score is often considered a significant milestone in the credit world. In this article, we’ll delve into the intricacies of a 750 credit score, exploring what it means, how to achieve it, and why it’s essential for your financial well-being.

What Is a Credit Score?

Before we dive into the specifics of a credit score, let’s first understand what a credit score is and why it matters.

Definition of a Credit Score

It reflects your credit history, payment habits, and overall financial responsibility. Lenders, banks, and financial institutions use this score to assess the risk of lending to you.

The Significance of a 750 Credit Score

Now that we have a basic understanding of credit scores, let’s explore why a 750 credit score is highly regarded.

Access to Better Financial Opportunities

A 750 credit opens doors to a plethora of financial opportunities. This score makes you more likely to qualify for loans, credit cards, and mortgages with favorable terms and lower interest rates. This means significant savings over the life of your loans.

Lower Interest Rates

One of the most compelling reasons to aim for a 750 credit is the potential for lower interest rates. Lenders view individuals with high credit scores as lower-risk borrowers, resulting in lower interest rates on loans and credit cards. This translates to reduced monthly payments and substantial long-term savings.

Faster Loan Approval

In urgent financial situations, the speed of loan approval can be critical. Acredit score can expedite the approval process, providing access to funds when needed most.

Achieving a 750 Credit Score

Now that you understand the advantages of a credit score, let’s discuss how to achieve this financial milestone.

Timely Payments

Consistently making payments on time is the cornerstone of a good credit score. Ensure that you pay your bills, loans, and credit card balances by their due dates to avoid late payment penalties and negative marks on your credit report. Read more…

Monitoring Your Credit Score

Maintaining a 750 credit requires vigilance and monitoring.

Conclusion

In conclusion, a 750 credit score is not just a number; it represents financial freedom, access to better opportunities, and reduced financial stress. Achieving and maintaining this score requires responsible financial habits and a commitment to financial well-being.

FAQs

1. What is the significance of a 750 credit score?

A 750 credit provides access to better financial opportunities, lower interest rates, and faster loan approvals.

2. How can I achieve a credit score?

To achieve a credit score, focus on timely payments, reducing credit card balances, and diversifying your credit mix.

3. Why is monitoring my credit score important?

Monitoring your credit score helps you identify errors, discrepancies, and potential identity theft, ensuring your financial health.

4. What is considered a good credit card utilization rate?

A credit card utilization rate below 30% is considered good for maintaining a high credit score.

5. Can a credit score be improved further?

With continued responsible financial management, you can further improve your credit score beyond 750, opening up even more financial opportunities.