Are you considering purchasing land but uncertain about the financial implications? A loan calculator can be a valuable tool to help you estimate your loan payments accurately. This comprehensive guide will walk you through the process of using a land loan calculator and provide insights into the factors that affect land loan calculations.

Understanding Land Loans

Before delving into land loan calculations, it’s crucial to understand what land loans are. A land loan is a financial product specifically designed for purchasing undeveloped land. Whether you plan to build a house, start a farm, or invest in raw land, land loans provide the necessary funding for acquiring the property.

Factors Affecting Land Loan Calculations

Several factors come into play when calculating land loan payments. The key elements include:

Loan Amount

The loan amount refers to the total sum of money you borrow from a lender to purchase the land. It’s essential to determine an accurate loan amount to get precise calculations.

Interest Rate

The interest rate is the cost of borrowing money from the lender, expressed as a percentage. The rate varies depending on factors such as your creditworthiness, loan term, and market conditions. A higher interest rate will result in larger loan payments.

Loan Term

The loan term is the duration within which you are expected to repay the loan. A longer loan term means smaller monthly payments but potentially higher overall interest costs.

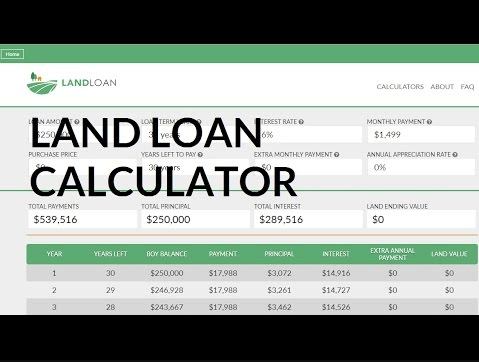

How to Use a Land Loan Calculator

Using a land loan calculator is a straightforward process. Follow these steps to calculate your land loan payments accurately:

Step 1: Gather Information

Before using the calculator, gather essential information such as the loan amount, interest rate, and loan term. Having these details at hand will streamline the calculation process.

Step 2: Enter Loan Details

Once you have the necessary information, input it into the loan calculator.

Step 3: Review and Analyze Results

After entering the required information, the calculator will generate the estimated monthly payment for your land loan. Take the time to review and analyze the results, ensuring they align with your financial goals.

Benefits of Using a Land Loan Calculator

Utilizing a loan calculator offers several advantages, including:

- Accurate Estimation: A land calculator provides precise calculations, allowing you to plan your budget effectively.

- Time-Saving: By automating the calculation process, a loan calculator saves you time and effort compared to manual calculations.

- Comparison Tool: With a calculator, you can compare different loan scenarios by adjusting variables such as loan amount, interest rate, and loan term.

Tips for Land Loan Borrowers

When seeking a land loan, consider the following tips to make the process smoother:

- Research Lenders: Explore multiple lenders to find the most favorable terms and interest rates for your land loan.

- Improve Credit Score: A higher credit score improves your chances of securing a loan with lower interest rates.

- Save for a Down Payment: Saving for a substantial down payment reduces the loan amount, resulting in more favorable terms. Read more…

Conclusion

Calculating land loan payments is a crucial step in planning for the purchase of undeveloped land. By utilizing a land loan calculator, you can estimate your loan payments accurately and make informed decisions. Remember to consider factors such as loan amount, interest rate, and loan term while using the calculator. With the right information at hand, you’ll be better equipped to navigate the land loan process confidently.

FAQs

1. Can I use a loan calculator for other types of loans? A loan calculator is specifically designed for land loans, but you can find calculators tailored to other loan types, such as mortgages or auto loans.

2. Are loan calculators accurate? loan calculators provide accurate estimations based on the information you input. However, keep in mind that the results are only estimates and may vary based on factors such as loan terms and interest rate fluctuations.

3. Is it necessary to use a loan calculator? While not mandatory, using a land calculator offers significant benefits. It allows you to plan your finances effectively and compare different loan scenarios to make informed decisions.

4. Can I calculate land loan payments manually? Yes, you can calculate land loan payments manually, but it can be time-consuming and prone to errors. Utilizing a loan calculator streamlines the process and ensures accuracy.

5. Where can I find a reliable land calculator? Many financial institutions and online resources provide loan calculators. Ensure you choose a reputable source to access reliable and up-to-date calculators.