In the pursuit of homeownership, many prospective buyers explore various loan options. One such option is the USDA loan, which has garnered attention for its unique eligibility criteria. Understanding the loan map is essential to embark on this homeownership journey. In this comprehensive guide, we’ll navigate the intricacies of the USDA loan map and shed light on its significance.

What is a USDA Loan?

Before delving into the map, let’s briefly discuss what a USDA loan entails. The United States Department of Agriculture (USDA) offers loans to eligible rural and suburban homebuyers, promoting homeownership in areas that traditional lenders might otherwise overlook. These loans are known for their competitive interest rates and flexible eligibility requirements, making them an attractive option for many.

The Importance of the USDA Loan Map

The USDA loan map plays a pivotal role in determining whether a property is eligible for financing under this program. Here’s why understanding it is crucial:

1. Identifying Eligible Areas

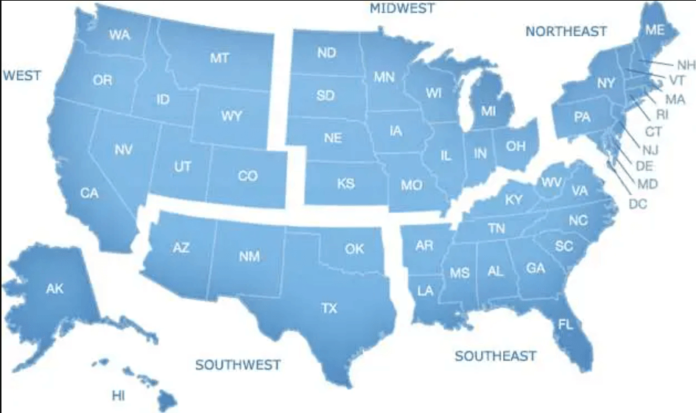

The USDA divides regions into two main categories: rural and suburban. Your prospective property must fall within these designated areas to qualify for a USDA loan. The map helps you pinpoint which areas are eligible, giving you a clear idea of where you can buy a home with this loan.

2. Access to Affordable Housing

The USDA loan program aims to provide affordable housing options to individuals and families who might not have other financing alternatives. You can discover affordable housing opportunities in areas meeting the program’s criteria using the loan map.

Navigating the USDA Loan Map

Now that we’ve emphasized the importance of the loan map, let’s explore how to navigate it effectively.

1. Visiting the USDA Website

The USDA provides an online tool to access the loan eligibility map. Simply visit their website and enter the property address you’re interested in.

2. Checking Eligibility

Once you’ve entered the address, the tool will indicate whether the property falls within an eligible area. You’re one step closer to securing a USDA loan if it does.

3. Seeking Professional Guidance

Navigating the loan map can sometimes be complex, especially if you’re unsure about certain boundaries or areas. It’s advisable to consult with a qualified real estate agent or lender who has experience with USDA loans.

Eligibility Criteria

To gain a better understanding of whether your desired property is eligible, let’s look at some key eligibility criteria:

1. Population Threshold

USDA loans are typically available for properties in areas with a population of 35,000 or less. This criterion aims to support rural and less densely populated regions.

2. Income Limits

Your income plays a crucial role in USDA loan eligibility. Therefore, your income should not exceed the limits set for your area.

3. Property Requirements

USDA loans have specific property requirements, such as adequate living conditions, safety standards, and, in some cases, restrictions on the size of the land. Ensure that your chosen property meets these criteria.

Applying for a USDA Loan

Once you’ve confirmed that your desired property is eligible, it’s time to start the application process. Here are the steps to follow:

1. Find a USDA-Approved Lender

Locate a lender with experience in USDA loans.

2. Gather Required Documents

Prepare your financial documents, such as income verification, credit history, and employment records.

3. Submit Your Application

Complete the lender’s application form and provide all required documents. The lender will review your application and determine whether you qualify for a USDA loan. Read more…

Conclusion

Navigating the USDA loan map is vital in the homeownership journey. By understanding the eligibility criteria and effectively using the map, you can unlock the doors to affordable housing in rural and suburban areas. The USDA loan program provides a valuable opportunity for many Americans to achieve their dream of owning a home.

FAQs

1. What is the main advantage of a USDA loan?

A USDA loan offers competitive interest rates and requires no down payment, making homeownership more accessible.

2. Can I use a USDA loan to purchase any home in a rural area?

No, the property must meet specific USDA requirements, and not all homes in rural areas are eligible.

3. Are USDA loans only for first-time homebuyers?

No, USDA loans are available to both first-time and repeat homebuyers who meet the eligibility criteria.

4. Is mortgage insurance required for USDA loans?

Yes, USDA loans require mortgage insurance, which can be financed into the loan amount or paid monthly.