Buying a home is a significant milestone for many individuals and families. However, the process of securing a mortgage can be overwhelming and confusing. If you are considering purchasing a new home or refinancing your existing mortgage, it’s crucial to understand the options available to you. One reputable lender that can assist you in this journey is BMO Harris Bank. This article will explore everything you need to know about BMO Harris Mortgage, including their offerings, the application process, and the benefits of choosing them as your mortgage provider.

1. Understanding BMO Harris Banks

With a strong presence in the United States. With a history that spans over a century, the bank has earned a reputation for providing quality financial products and services, including home loans. Their commitment to customer satisfaction and competitive mortgage rates makes them an attractive option for potential homebuyers.

2. BMO Harris Mortgage Products

BMO Harris offers a diverse range of mortgage products tailored to meet various needs. Whether you are a first-time homebuyer or a seasoned homeowner looking to refinance, they have options to suit your requirements. Some of their popular mortgage products include:

2.1 Fixed-Rate Mortgages

A fixed-rate mortgage comes with a steady interest rate over the loan term. This stability allows borrowers to plan their finances better, as the monthly payment remains unchanged. It’s ideal for those who prefer predictability in their mortgage payments.

2.2 Adjustable-Rate Mortgages (ARMs)

Adjustments based on prevailing market rates. These mortgages may be more suitable for those planning to move or refinance in the near future.

2.3 Government-backed Loans

BMO Harris also provides government-backed loans, such as FHA, VA, and USDA loans, catering to homebuyers who qualify for specific programs.

3. The Mortgage Application Process

Process, but BMO Harris strives to make it as seamless as possible. Here are the general steps involved in their mortgage application process:

3.1 Prequalification

The first step is to get prequalified, which financial situation. Prequalification helps you set a budget for your home search.

3.2 Mortgage Application

Once you’ve found your dream home, you can proceed to complete the mortgage application. BMO Harris will review your financial information and assess your eligibility.

3.3 Documentation

Prepare the necessary documents, such as income statements, tax returns, and identification, as part of the application process.

3.4 Underwriting

BMO Harris will carefully evaluate your application and documentation during underwriting to determine the final loan approval.

3.5 Closing

After approval, you’ll reach the closing stage, where you’ll sign the final documents and complete the mortgage process.

4. Benefits of Choosing BMO Harris Mortgage

Opting for BMO Harris Mortgage comes with several advantages:

4.1 Competitive Interest Rates

BMO Harris offers competitive interest rates, enabling borrowers to secure a mortgage with favorable terms.

4.2 Flexible Terms

The bank provides various mortgage terms, allowing borrowers to choose the one that aligns with their financial goals.

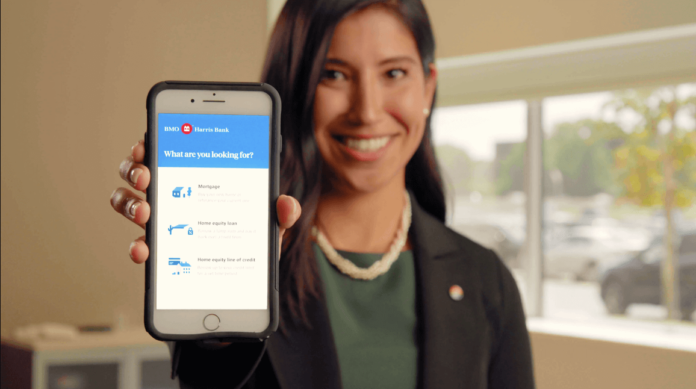

4.3 Online Tools and Resources

BMO Harris offers an array of online tools and resources, empowering borrowers to calculate payments, explore loan options, and access educational materials.

4.4 Excellent Customer Service

With a commitment to customer satisfaction, BMO Harris ensures that their team of mortgage experts provides exceptional service to assist borrowers throughout the process. Read more…

5. Conclusion

Decision, and choosing the right mortgage lender is vital to ensure a smooth and satisfying experience. BMO Harris Bank, with its extensive history, diverse mortgage offerings, and commitment to customer service, emerges as a reputable choice for aspiring homeowners. Whether you are a first-time homebuyer or looking to refinance, BMO Harris has a mortgage product to suit your needs.

FAQs – Your Mortgage Questions Answered

- What factors affect the interest rate I receive?

The interest rate you receive depends on various factors, including your credit score, down payment, loan term, and current market rates. - Does BMO Harris offer any special mortgage programs for veterans?

Yes, BMO Harris offers VA loans, specifically designed to support veterans and active-duty military personnel in homeownership. - Is BMO Harris available nationwide?

While BMO Harris has a strong presence in several states, checking their availability in your specific location is essential.