In today’s fast-paced world, financial stability and access to reliable loans play a crucial role in achieving our dreams and aspirations. If you’re looking for a trusted financial institution that offers a wide range of loan options, BMO Harris Bank is a name you can trust. In this article, we will explore the world of BMO Harris loan and how they can help you accomplish your financial goals.

1. Understanding BMO Harris Bank

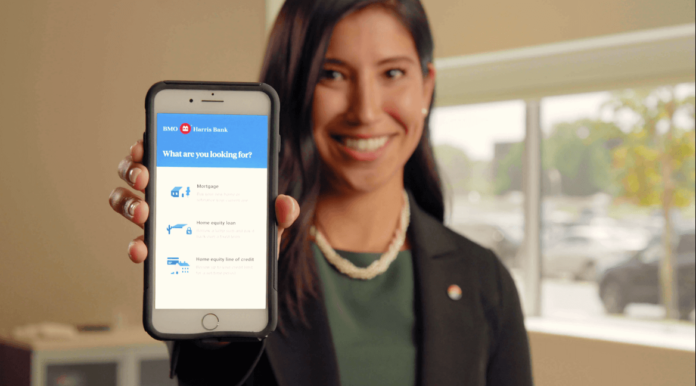

BMO Harris Bank is a leading financial institution with a rich history spanning over 135 years. Known for its commitment to customer service and innovation, BMO Harris Bank offers a wide range of financial products and services, including loans, mortgages, credit cards, and more. With a strong presence across the United States, BMO Harris Bank has established itself as a trusted partner for individuals and businesses alike.

2. Types of Loans Offered by BMO Harris Bank

2.1 Mortgage Loans

Owning a home is a dream for many, and BMO Harris Bank understands the importance of turning this dream into reality. With their mortgage loan options, you can find the perfect financing solution to purchase your dream home or refinance your existing mortgage. BMO Harris offers fixed-rate mortgages, adjustable-rate mortgages, and jother specialized mortgage products to cater to different needs.

2.2 Personal Loans

Whether you’re planning a wedding, consolidating debt, or funding a major purchase, BMO Harris Bank’s personal loans can provide the financial support you need. With competitive interest rates and flexible repayment terms, these loans offer convenience and flexibility to help you achieve your personal goals.

3. Eligibility Criteria for BMO Harris Loan

Before applying for a loan with BMO Harris Bank, it’s important to understand the eligibility requirements. While specific criteria may vary based on the type of loan you’re applying for, here are some common factors to consider:

3.1 Age and Residency Requirements

To qualify for a BMO Harris loan, you must be at least 18 years old and a legal resident of the United States. Some loan products may have additional residency or citizenship requirements.

3.2 Credit Score and History

BMO Harris Bank evaluates your creditworthiness to assess the risk of lending to you. While a higher credit score increases your chances of approval and better loan terms, BMO Harris Bank also offers options for individuals with less-than-perfect credit.

4. Applying for a Harris Loan

Now that you understand the types of loans offered by BMO Harris Bank and the eligibility criteria, let’s explore the process of applying for a loan:

4.1 Gather Required Documents

Before starting the application process, gather all the necessary documents, such as identification proof, income documents, bank statements, and any other information that may be required for the specific loan type.

4.2 Research Loan Options

Evaluate your financial needs and research the different loan options available from BMO Harris Bank. Consider factors such as interest rates, repayment terms, and any special features or benefits offered by each loan product.

5. Understanding the Loan Approval Process

After submitting your loan application, BMO Harris Bank will initiate the loan approval process.

5.1 Initial Review

Upon receiving your application, BMO Harris Bank will conduct an initial review to verify the accuracy and completeness of the information provided.

5.2 Verification and Underwriting

During this stage, BMO Harris Bank will verify the information provided in your application, such as your income, employment details, credit history, and collateral (if applicable). They will also assess your overall creditworthiness and determine the risk associated with lending to you.

6. Managing Your BMO Loan

Once you’ve secured a loan from BMO Harris Bank, it’s essential to manage it effectively to ensure financial stability. Here are some tips for managing your Harris loan:

6.1 Making Timely Payments

Make your loan payments on time each month to maintain a positive credit history and avoid late fees or penalties. Set up automatic payments or reminders to help you stay organized and never miss a payment.

6.2 Accessing Account Information Online

Take advantage of BMO Harris Bank’s online banking services to access your loan account information, view statements, and make payments conveniently from anywhere at any time. Read more…

7.Frequently Asked Questions (FAQs)

8.1 Can I apply for a Harris loan online?

Yes, BMO Harris Bank offers online loan applications for convenience and accessibility. Visit their website to explore loan options and begin the application process.

8.2 How longdoes the loan approval process take?

The duration of the loan approval process can vary depending on several factors, including the type of loan, the complexity of your application, and the volume of applications being processed. Generally, BMO Harris Bank strives to provide a prompt decision and aims to complete the process within a few business days.

8.3 What is the minimum credit score required for a Harris loan?

The minimum credit score required for a BMO Harris loan may vary depending on the type of loan you’re applying for. Generally, a higher credit score increases your chances of approval and may result in more favorable loan terms. However, BMO Harris Bank also offers options for individuals with less-than-perfect credit.

9. Conclusion

Securing a loan from a trusted financial institution like BMO Harris Bank can provide the necessary funds to accomplish your financial goals. With a wide range of loan options, competitive interest rates, and excellent customer service, BMO Harris Bank is dedicated to helping individuals and businesses achieve their dreams. Take the first step towards a brighter financial future by exploring the loan options available to you through BMO Harris Bank.